Calculate loan payment student – Navigating the complexities of student loan payments can be daunting, but understanding the key factors involved is crucial for managing your debt effectively. This guide will provide a comprehensive overview of calculating student loan payments, exploring the factors that influence them, and outlining the various repayment options available to borrowers.

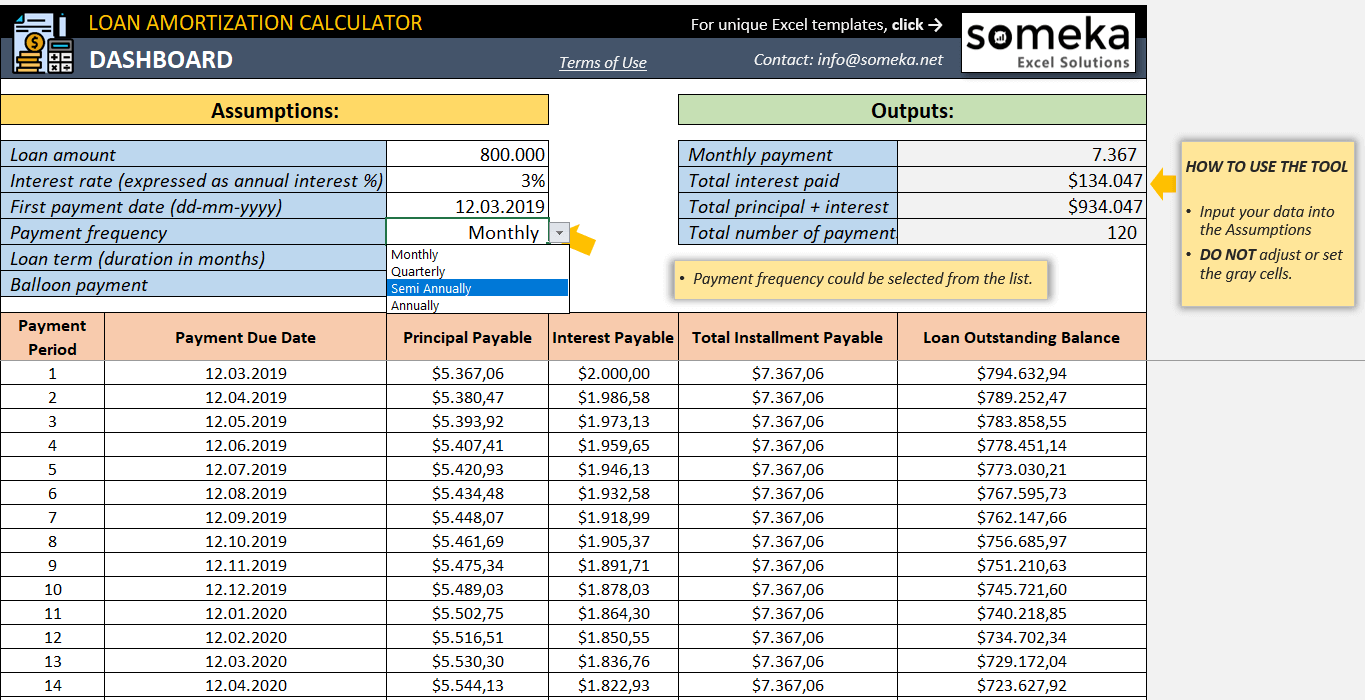

To determine your monthly loan payment, you’ll need to consider the loan amount, interest rate, and loan term. These elements play a significant role in shaping the total cost of your loan and the length of time it will take to repay.

Loan Payment Calculation

Calculating student loan payments involves determining the monthly amount owed to repay the borrowed funds over a specific period. This calculation considers factors such as the loan amount, interest rate, and loan term.

Formula for Loan Payment Calculation

The standard formula for calculating student loan payments is:

Monthly Payment = (Loan Amount x Interest Rate) / (1

(1 + Interest Rate)^(-Loan Term))

Where:

- Loan Amount: The total amount borrowed

- Interest Rate: The annual interest rate expressed as a decimal (e.g., 5% = 0.05)

- Loan Term: The number of months over which the loan will be repaid

Example of Loan Payment Calculation

For example, consider a student loan of $10,000 with an interest rate of 4% and a loan term of 10 years (120 months):

Monthly Payment = ($10,000 x 0.04) / (1 – (1 + 0.04)^(-120)) = $106.23

Therefore, the monthly loan payment for this example would be $106.23.

Factors Affecting Loan Payments

Understanding the factors that influence student loan payments is crucial for borrowers to make informed decisions about their repayment plans. Several key factors play a significant role in determining the monthly payment amount and the overall cost of borrowing.

Loan Amount

The principal amount borrowed is a primary determinant of loan payments. A higher loan amount translates to larger monthly payments. This is because the borrower is responsible for repaying the borrowed funds, plus any accumulated interest, over the loan term.

Interest Rate

The interest rate is a percentage charged on the outstanding loan balance. It significantly impacts the total cost of the loan and the monthly payment amount. Higher interest rates result in higher monthly payments and a greater overall cost of borrowing.

Loan Term

The loan term refers to the duration over which the loan is to be repaid. A longer loan term typically leads to lower monthly payments. However, it also means paying more interest over the life of the loan, resulting in a higher total cost of borrowing.

Loan Repayment Options

Student loans come with various repayment options to accommodate individual financial situations and goals. Understanding these options is crucial for managing student debt effectively.

The repayment options primarily vary based on factors such as the loan amount, interest rate, and the borrower’s income and expenses.

Standard Repayment Plan

The standard repayment plan is a fixed-term loan with a predetermined number of payments (typically 10 years for federal loans and 5 to 15 years for private loans). The monthly payment amount remains the same throughout the loan term, and the loan is fully paid off by the end of the repayment period.

Graduated Repayment Plan

The graduated repayment plan offers lower monthly payments initially, which gradually increase over the loan term. This option can be beneficial for borrowers who anticipate a higher income in the future and prefer lower payments in the early years of repayment.

Extended Repayment Plan

The extended repayment plan allows borrowers to extend the repayment period beyond the standard 10-year term. This option results in lower monthly payments but also extends the overall interest charges paid over the life of the loan.

With careful planning, students can calculate student loan payments that fit within their financial means. Using online calculators or consulting with financial advisors can provide personalized estimates based on loan amount, repayment period, and interest rates. By understanding their repayment obligations, students can make responsible choices and minimize the financial burden of their education.

Income-Driven Repayment Plan

Income-driven repayment plans adjust the monthly payment amount based on the borrower’s income and family size. These plans are designed to make student loan repayment more affordable for borrowers with lower incomes.

Loan Forgiveness Programs

For student loan borrowers, loan forgiveness programs provide an opportunity to have their remaining debt discharged. These programs are designed to encourage individuals to pursue careers in public service or other fields that face staffing shortages.

Two notable loan forgiveness programs include the Public Service Loan Forgiveness Program and the Teacher Loan Forgiveness Program.

Public Service Loan Forgiveness Program

The Public Service Loan Forgiveness Program (PSLF) provides loan forgiveness to individuals who work full-time in public service for at least 10 years and make 120 qualifying payments on their federal student loans. Eligible public service employment includes working for government agencies, non-profit organizations, and other qualifying entities.

To qualify for PSLF, borrowers must meet the following requirements:

- Have federal student loans (Direct Loans, FFEL Loans, or Perkins Loans)

- Work full-time for a qualifying public service employer

- Make 120 qualifying payments on their student loans while working in public service

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program provides loan forgiveness to teachers who work full-time for at least five consecutive years in a low-income school or educational service agency. Eligible teachers can receive up to $17,500 in loan forgiveness.

To qualify for Teacher Loan Forgiveness, borrowers must meet the following requirements:

- Have federal student loans (Direct Loans or FFEL Loans)

- Work full-time as a teacher in a low-income school or educational service agency

- Teach for at least five consecutive years

Loan Consolidation

Student loan consolidation combines multiple student loans into a single loan with a single monthly payment. This can simplify repayment and potentially reduce interest costs. However, it’s important to weigh the benefits and drawbacks before consolidating.

Benefits of Loan Consolidation

- Simplified repayment:Consolidate multiple loans into one, making it easier to track and manage payments.

- Potentially lower interest rates:Consolidation may qualify borrowers for lower interest rates, resulting in lower monthly payments and interest savings over time.

- Extended repayment terms:Consolidation can extend repayment terms, lowering monthly payments but increasing the total interest paid.

Drawbacks of Loan Consolidation

- Loss of certain benefits:Consolidation may result in the loss of certain loan benefits, such as loan forgiveness or income-driven repayment plans.

- Higher total interest costs:Extending repayment terms may increase the total interest paid over the life of the loan.

- Potential credit score impact:Applying for consolidation can result in a hard credit inquiry, which may temporarily lower credit scores.

How to Consolidate Student Loans

- Choose a lender:Select a lender that offers consolidation loans and meets your needs.

- Gather loan information:Collect account numbers, balances, and interest rates for all loans you wish to consolidate.

- Apply for consolidation:Complete the lender’s application and submit required documentation.

- Receive loan approval:Once approved, the lender will pay off your existing loans and issue a new consolidated loan.

Loan Refinancing

Refinancing student loans involves replacing existing student loans with a new loan, typically with a lower interest rate or more favorable repayment terms. It can help borrowers save money on interest and potentially pay off their loans faster.

Students considering higher education often face the daunting task of financing their studies. Calculating student loan payments is crucial for budgeting and planning for the future. Understanding the monthly payment amount and interest rates can help students make informed decisions about their loan options.

Refinancing is usually done through a private lender and requires good credit and a steady income. The process typically involves applying for a new loan, getting approved, and using the funds to pay off the existing student loans.

Pros of Refinancing

- Lower interest rates: Refinancing can significantly reduce interest rates, leading to lower monthly payments and overall savings.

- Shorter loan terms: Refinancing allows borrowers to shorten their loan terms, resulting in faster repayment and reduced interest charges.

- Consolidation: Refinancing can consolidate multiple student loans into a single loan, simplifying repayment and potentially lowering interest rates.

Cons of Refinancing

- Credit score impact: Applying for a refinance loan can result in a temporary dip in credit score.

- Loss of federal benefits: Refinancing federal student loans into private loans means losing access to federal benefits such as income-driven repayment plans and loan forgiveness programs.

- Higher fees: Private lenders may charge origination fees or other closing costs associated with refinancing.

Resources for Student Loan Borrowers: Calculate Loan Payment Student

Navigating the complexities of student loans can be daunting. To assist borrowers, numerous resources are available to provide guidance and support.

Federal Student Aid Website, Calculate loan payment student

The Federal Student Aid website serves as a comprehensive resource for student loan borrowers. It offers a wealth of information on loan repayment options, forgiveness programs, and other assistance programs. Borrowers can also access their loan details, make payments, and apply for deferment or forbearance.

Student Loan Ombudsman

The Student Loan Ombudsman is an independent office within the U.S. Department of Education that assists borrowers with resolving disputes and complaints related to their student loans. The Ombudsman can provide guidance on repayment options, forgiveness programs, and other loan-related issues.

Final Wrap-Up

Understanding the nuances of student loan payments empowers borrowers to make informed decisions about their financial future. By carefully considering the factors discussed in this guide and exploring the available repayment options, you can develop a strategy that aligns with your individual circumstances and goals.

FAQ Insights

How do I calculate my student loan payment?

To calculate your monthly student loan payment, use the following formula: P = (r – A) / (1 – (1 + r)^(-n)), where P is the payment, r is the monthly interest rate (annual interest rate divided by 12), A is the loan amount, and n is the number of months over which the loan will be repaid.

What factors affect my student loan payment?

The primary factors that influence your student loan payment are the loan amount, interest rate, and loan term. A higher loan amount, higher interest rate, or longer loan term will result in higher monthly payments.

What are my student loan repayment options?

There are several student loan repayment options available, including the Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, and Income-Driven Repayment Plan. Each plan offers different repayment terms and monthly payment amounts.